Why are there more goals in Ligue 1 McDonald's?

It had been 46 years since Ligue 1 McDonald’s posted such a high goals-per-game average (3 vs 2.98). Back then, the league’s leading men were Carlos Bianchi (PSG), Delio Onnis (AS Monaco), and Eric Pécout (FC Nantes)—all of whom scored at least 22 goals in a season where six players hit 20+.

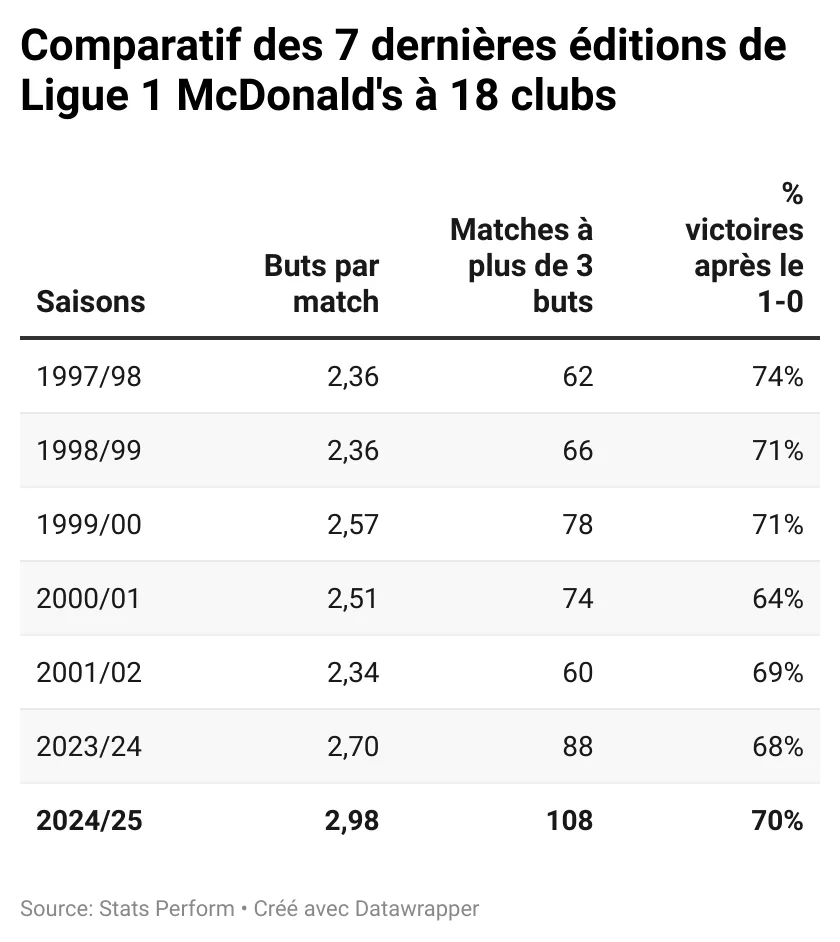

While only two players reached the 20-goal mark in 2024/25 (Dembélé and Greenwood, both with 21 goals), and Mika Biereth delivered a stellar second half of the season for Monaco (13 goals in 16 matches), the collective offensive output in Ligue 1 McDonald’s was historic, averaging 2.98 goals per game, or 911 goals across 306 matches.

Among 18-team seasons, this one—which ended on May 17 with a record 38 goals on the final day—had the highest total since 1969/70 (973 goals).

Among Europe's Best

This performance places Ligue 1 McDonald’s among Europe’s top-scoring leagues, ahead of Serie A (2.54 goals/game) and LaLiga (2.62), and level with the Premier League (2.93), while Belgium (2.62) and Portugal (2.57) lag behind. Only the Bundesliga has a higher average (3.13), and its historically attacking mindset seems to be taking root in France.

STAT: Paris Saint-Germain scored 92 goals. Only two teams have scored more in an 18-team Ligue 1 McDonald’s season: Lille (102) and Marseille (95) in 1948/49.

Entertainment was consistent across the season, especially with the surge in high-scoring matches. In 2024/25, 108 matches featured more than 3 goals, 20 more than last season. That includes 27 matches with at least 6 goals (vs 16 in 2023/24), led by AS Monaco–FC Nantes (7-1) and OGC Nice–AS Saint-Étienne (8-0).

Why This Shift Toward More Goals?

Attack: New Trends Emerging

The 2024/25 campaign reinforced an ongoing trend: teams taking more risks in Ligue 1 McDonald’s.

STAT:

OM overperformed their expected goals (xG) more than any other side this season, with a +8.94 differential (74 goals from 65.06 xG).

Teams now press higher, with their average line of engagement 2 metres further up the pitch than ten years ago.

They also attempt fewer long shots (down from 9 to 8 per match) but more shots inside the box (up from 16.6 to 17). While total shots remained constant, this led to better finishing. Since 2020/21, conversion rates have exceeded 11%, peaking at 11.9% this season.

Even with a comparable number of chances, teams were more clinical, scoring 85 more goals than in 2023/24.

Counter-Attack Goals on the Rise

The season also saw a sharp increase in goals scored from counter-attacks, suggesting that teams are willing to risk exposure going forward—even if it means conceding.

Counter-attack goals reached 108, a 74% increase over last season. Even compared to seasons with 20 teams and 380 matches (74 more than now), this is a record.

More Big Chances Created—and Scored

With this offensive philosophy, all 18 top-tier clubs became more dangerous, creating a record number of big chances. In 2024/25, there were 5.26 big chances per match—a 24% rise from last season, with 309 more overall.

And the ability to convert these big chances also improved: 112 more goals were scored from such situations compared to 2023/24.

STAT:

Against Lens on May 4, Lyon touched the ball 75 times in the opponent's box, the highest recorded by Opta in Ligue 1 McDonald’s since it began tracking in 2006/07.

Effective Playing Time Among Europe’s Best

More effective playing time means more chances to score. This season, Ligue 1 McDonald’s averaged 56’40 of active play per match, second only to the Dutch Eredivisie (56’42), and ahead of:

Bundesliga: –1’35

Premier League: –2’04

Serie A: –3’04

LaLiga: –3’16

The reduction to 18 teams since 2023/24 has tightened the league and made teams more attack-oriented, with PSG and OM setting the pace.

Where Are the Goals Coming From?

Last season, only four clubs (PSG, Monaco, Lorient, OL) saw their matches total over 100 goals. This season? Eleven teams reached that threshold.